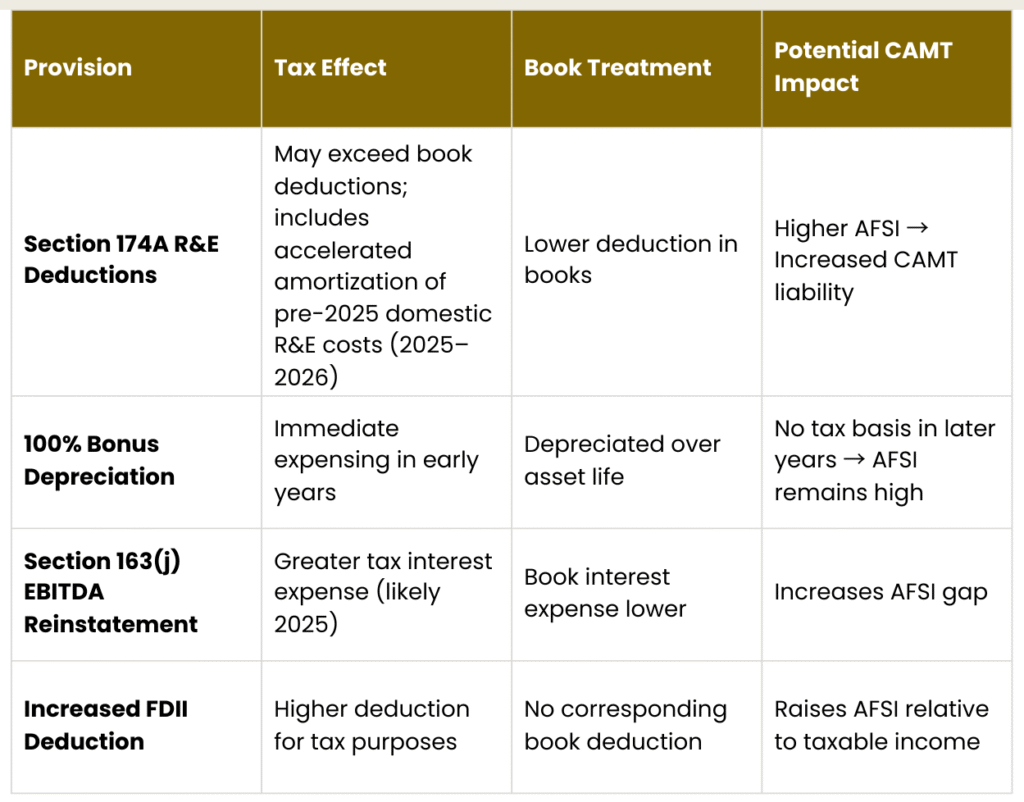

The One Big Beautiful Bill Act (OBBBA) introduces targeted modifications that intersect directly with the Corporate Alternative Minimum Tax (CAMT) regime. While several provisions create new planning opportunities for private equity (PE) funds and portfolio companies, the legislation also preserves key tax treatments that support market stability.

For fund managers, these changes require balancing immediate opportunities with longer-term strategic considerations in modeling, structuring, and investor communications. Importantly, many of OBBBA’s favorable “regular” tax provisions may unintentionally increase CAMT exposure. This is because they reduce taxable income without lowering adjusted financial statement income (AFSI). The result: potential CAMT liability even in years when regular tax benefits are available, along with challenges in utilizing CAMT credits under general business credit ordering rules.

CAMT Update Expands Options for Partnerships While Urging Prudence

The Treasury and IRS recently released Notice 2025-28 (the “Notice”), which sets out measures intended to simplify how the CAMT rules apply in the context of partnerships. Although positioned as a compliance-friendly step for corporations with partnership interests, the real-world application is more complex than the initial framing might imply, and the flexibility offered comes with important practical considerations.

In many cases, reliance on the Notice will also require reliance on portions of the CAMT proposed regulations, bringing with them their inherent complexities. Moreover, several of the elections introduced under the Notice are not straightforward to apply and may carry adverse consequences in subsequent years.

To navigate these provisions effectively, taxpayers will need to model the potential effects of making the available elections or otherwise applying the Notice, taking into account both current and future AFSI impacts. Given the binding nature of these elections, a multi-year forecasting approach is essential before making any decisions.

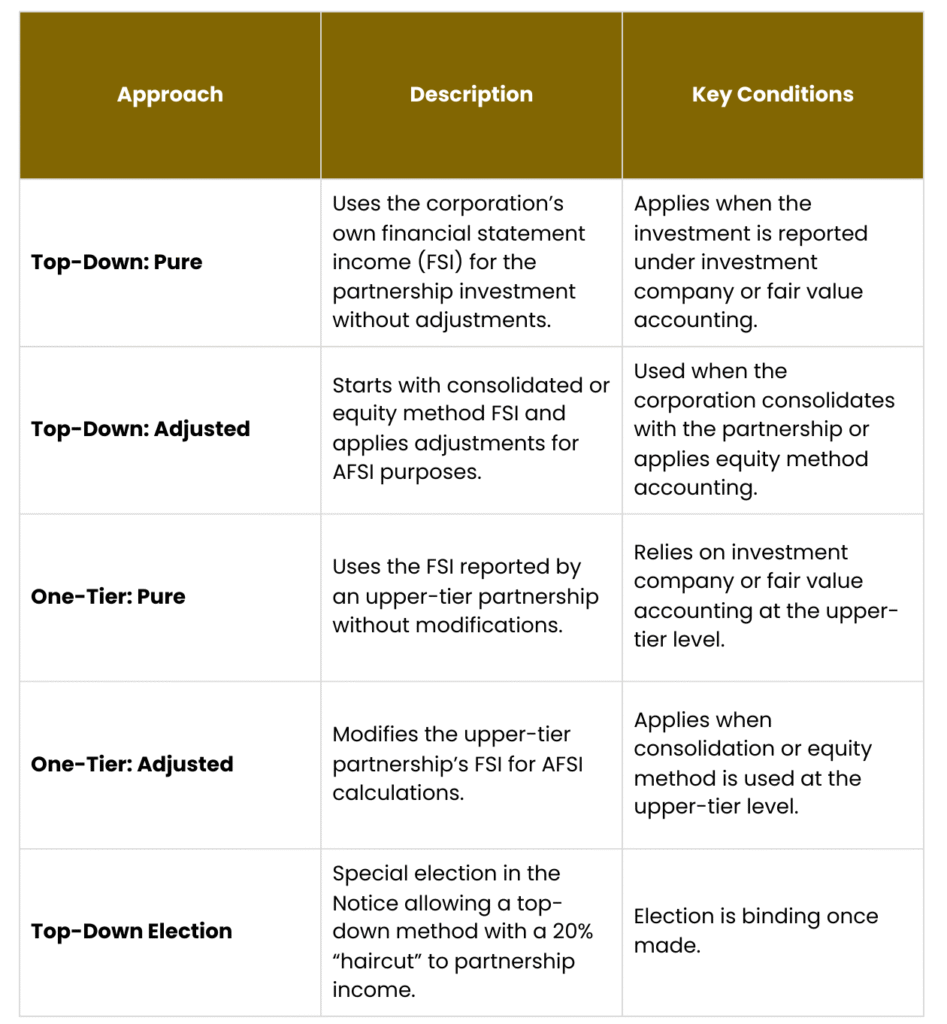

Approaches to Determining AFSI from Partnership Investments

Following the release of Notice 2025-28, applicable corporations now have multiple possible methods for determining their adjusted financial statement income (AFSI) related to partnership investments, even in situations that do not involve direct contributions to or distributions from the partnership.

These methods can generally be grouped into top-down and bottom-up approaches, each with variations depending on the financial accounting treatment, applicable rules, and elections available.

Key Considerations for Applying the Notice’s New and Elective Rules

When determining an applicable corporation’s distributive share of AFSI under the partnership rules in Notice 2025-28, several practical points require attention:

- Neither the Top-Down Election nor the Taxable-Income Election can be applied straight from reported financial statement income (FSI) or taxable income. Both require specific modifications to ensure the AFSI amount linked to the partnership is accurately calculated.

- Corporations are allowed to make different elections for different partnerships, even mixing Top-Down and Taxable-Income Elections across their portfolio. While this tailored approach can improve outcomes, it is subject to certain constraints and benefits most from robust modeling.

- Opting for either election means early adoption of the “-5” rules and a binding choice that generally stays in place until updated regulations are released. Given the long-term nature of these elections, multi-year projections and a clear view of the broader -5 rule impacts are essential before making a decision.

- Confirming qualification for this election can be complex, often requiring swift information exchange within a section 52 group or a foreign-parented multinational group. This data may not always be readily available within the short decision window.

- Despite its name, the Reasonable Method provides only limited flexibility. It applies when partnerships, under the -5 rules, calculate and report Modified FSI, and it places the responsibility for allocating those amounts on the partnership. While there is some discretion in setting allocation percentages, the practical range of options is narrower than the name suggests.

1. Top-Down Election

- Includes in AFSI 80% of a top-down amount for a partnership investment, after adjustments.

- Eligibility: Applicable corporation partners.

- Not available to upper-tier partnerships (even if they have applicable corporations as partners).

- Start with the CAMT entity’s FSI from the partnership.

- Adjust for certain items, then reduce by 20%.

- Apply additional adjustments to determine final AFSI.

- Election is made in the partner’s return for the election year, on an investment-by-investment basis.

- Likely requires adoption of the proposed -5 rules.

- More complex than some statutory top-down methods.

- Likely requires use of this method (or Taxable-Income Election / -5 rules) for all partnership investments.

- Could have negative AFSI impact if the partnership interest is sold.

- Loss limitation rules apply.

- Requires tracking the partner’s CAMT basis in the partnership investment.

2. Reasonable Method

- Lets the partnership use any reasonable method to determine each partner’s distributive share percentage of Modified FSI.

- Eligibility: Partnerships that have early adopted the -5 rules and are computing Modified FSI.

- Partnership calculates each partner’s share of Modified FSI.

- Uses a Reasonable Method to set allocation percentages.

- Partnership includes a statement in its return describing the method used.

- Requires partnership adoption of the proposed -5 rules.

- Binding on the partnership until the tax year before revised proposed regulations.

- Allows use of a tax provisions-based ratio instead of a book-based ratio.

- Moves the burden of distributive share calculation from partner to partnership.

3. Taxable-Income Election

- Uses the partnership’s taxable income (with adjustments) to determine AFSI.

- Eligibility: Applicable corporation partners whose CAMT test group:

- Owns ≤ 20% profits/capital interest, and

- Has < $200M FMV in the partnership investment.

- Not available to upper-tier partnerships (even with applicable corporations as partners).

- Start with the CAMT entity’s taxable income from the partnership.

- Adjust for specific items to arrive at AFSI.

- Election is made in the partner’s return for the election year, on an investment-by-investment basis.

- Likely requires adoption of proposed -5 rules.

- Binding on the partner until the tax year before revised proposed regulations, or earlier if eligibility ends.

- Simpler than -5 rules.

- Tax-based starting point (rather than book-based) can mean lower AFSI.

- Eligibility testing is complex and must be done each year.

- Likely requires use of this method (or Top-Down / -5 rules) for other partnership investments.

- Negative AFSI impact possible if the partnership interest is sold.

- Loss limitation rules apply.

- Requires tracking the partner’s CAMT basis in the partnership investment.

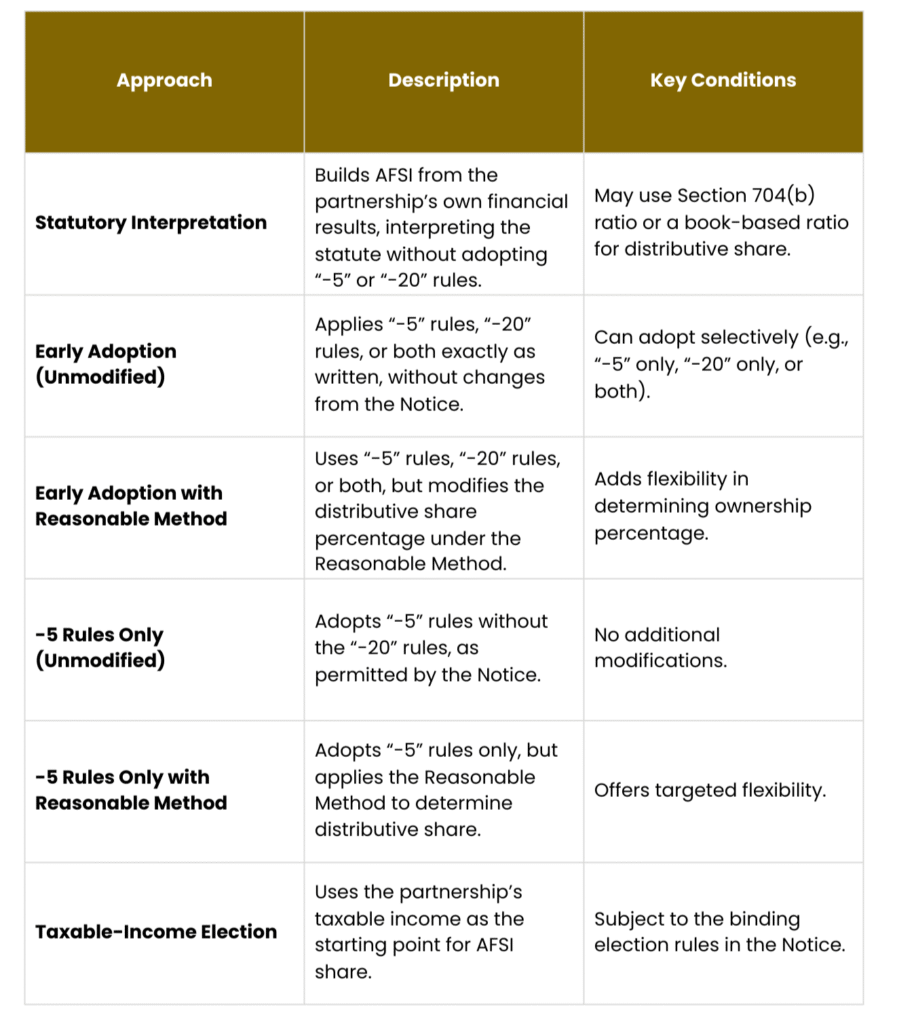

Approaches to Partnership Transactions under CAMT

In certain cases, a tax-free contribution to or distribution from a partnership can unexpectedly give rise to adjusted financial statement income (AFSI) for purposes of the Corporate Alternative Minimum Tax (CAMT). Recognizing this, the Treasury and IRS have exercised their regulatory authority to introduce mechanisms aimed at reducing or deferring that impact.

Following the release of Notice 2025-28, taxpayers now have a menu of six distinct approaches to postpone, for CAMT purposes, the financial statement income associated with such transactions. The choice of method often depends on whether the election is made at the partner level, the partnership level, or under specific eligibility conditions.

- An updated take on the proposed rules in Prop. Reg. Sec. 1.56A-20, offering an alternative computation for partnership contributions and distributions when chosen by an applicable corporate partner.

- A partnership-level election, requiring the agreement of all impacted partners, that applies Subchapter K principles for CAMT purposes to mirror conventional partnership tax treatment.

- Available to eligible partners, this option uses the partnership’s taxable income, rather than its financial statement income, as the starting point for calculating the partner’s share of AFSI.

- -20 Rules Without -5 Rules – Implements the original -20 rules in combination with certain designated regulations, but deliberately omits the -5 rules from application.

- -20 Rules With -5 Rules – Integrates the -20 rules, the -5 rules, and the designated regulations into a coordinated approach for determining AFSI.

- Reasonable Statutory Interpretation – Applies a taxpayer’s justified interpretation of the statute, which could support either full recognition of partner-level FSI from a contribution or complete exclusion of such income when contributed property is involved.

Deferring FSI from Partnership Contributions and Distributions : Key Methods

1. Modified -20 Method

- An election for any CAMT entity partner to apply the proposed -20 rules with targeted modifications, in order to determine AFSI from partnership contributions and distributions.

- Any CAMT entity partner is eligible.

- Include the election in the partner’s tax return for the election year.

- Likely requires adoption of the proposed -20 rules by the electing partner.

- Unclear if adoption of the proposed -5 rules is also necessary.

- Once elected, binding until the tax year before revised proposed regulations take effect.

- Generally simpler than the original proposed -20 rules.

- May offer more favorable treatment in certain areas (e.g., partnership debt, recovery rules, and acceleration events).

- In some cases, could be less favorable than the original -20 rules.

- Uncertainty on how the election affects partnership-level reporting.

- Partnerships may need to maintain multiple CAMT books to track deferred sales property and related gain/loss events.

2. Full Subchapter K Method

- An election by the partnership (with consent of all relevant partners) to apply Subchapter K principles when determining AFSI for contributions and distributions.

- Only partnerships, not individual partners are eligible.

- Election is made in a partnership’s tax return for the election year.

- Must be applied to all contributions and distributions for the partnership.

- Once made, binding until the tax year before revised proposed regulations take effect.

- In certain situations, more favorable than both the original -20 rules and the Modified -20 Method.

- Creates a complex, parallel compliance system that may raise additional technical questions (e.g., handling partner-level FSI from contributions).

- Requires significant time and administrative investment.

- In some cases, could be less favorable than the other two methods.

Further Provisions under Notice 2025-28

In addition to its primary provisions, Notice 2025-28 introduces several clarifications relevant to taxpayers adopting the proposed -5 and/or -20 rules. One significant change allows taxpayers to exclude from AFSI any financial statement income resulting from consolidation, remeasurement, deconsolidation, dilution, or ownership changes involving another partner, so long as the event does not constitute a realization event.

The Notice also extends the reporting timelines for partnerships, providing more time to supply CAMT-related information to partners in accordance with the proposed regulations.

With respect to reliance rules under the proposed regulations, taxpayers are now permitted to adopt either the -5 rules or the -20 rules independently, rather than being required to adopt both—a “decoupling” approach. However, it appears that early adoption of the specified regulations remains a prerequisite.

Finally, for those relying directly on Notice 2025-28, there is an added degree of flexibility: taxpayers may adopt either the -5 rules or the -20 rules, as modified by the Notice, without also adopting the specified regulations or adhering to the test group consistency requirement.

Positioning for What Comes Next

Given the interaction between the OBBBA provisions and the elections under Notice 2025-28, taxpayers should conduct detailed, multi-year modeling to assess potential CAMT impacts. While certain OBBBA changes are favorable for regular tax purposes, they can also increase CAMT liabilities. Because these elections are binding, a thorough evaluation of their effect on AFSI, timing, and administrative requirements is essential. Strategic selection, based on a company’s specific facts, can offer meaningful advantages.

The information contained in this post is merely for informative purposes and does not constitute tax advice. For more information, feel free to reach us at [email protected]

Copyright 2025 Small World Business Advisors LLC www.swbadvisors.com