The One Big Beautiful Bill Act of July 4, 2025, implements comprehensive tax changes that seek to encourage business expansion, spur private investment, and increase the competitiveness of the U.S. economy. Although the legislation affects various industries, its consequence on the Private Equity (PE) sector is especially noteworthy.

This presentation provides an overview of the One Big Beautiful Bill Act (OBBBA) and its legislative purpose, along with an overview of main tax provisions important to the private equity sector. It cites what has changed, i.e., interest deductibility and QSBS improvements, and what has been left alone, such as carried interest treatment. The deck discusses how these reforms affect the fund level and the level of portfolio companies and presents new structuring and planning opportunities on the horizon. Collectively, these findings provide a strategic perspective on how OBBBA is transforming private equity investment, operations, and exit planning.

Key Highlights of OBBB –

- Signed into law on July 4, 2025.

- Reinstates full expensing for qualified property via 100% bonus depreciation.

- Raises the expensing cap under IRC Section 179 to $2.5 million.

- Returns to EBITDA-based limitation for interest deductions under Section 163(j).

- Expands QSBS exclusion threshold and introduces tiered holding period benefits.

- Leaves carried interest and long-term capital gains rates unchanged.

- Omits proposed foreign investor withholding tax (Section 899).

These provisions significantly influence fund strategy, capital structure, and tax modeling.

Carried Interest – What didn’t Change

- OBBBA preserves the current tax treatment for carried interest.

- Gains remain eligible for long-term capital gains rates if held for three or more years.

- This is a key win for general partners (GPs):

- Maintains incentive alignment

- Supports fundraising confidence

- Avoids disruption to fee structures

- Limited partners (LPs) also benefit:

- Ensures predictable fund economics

- Preserves net-of-fee return consistency

Interest Expense Deduction – IRC Section 163(j)

OBBBA resurrects the EBITDA-based restriction on interest expense deductions in place of the more constrictive EBIT-based rule. This amendment is especially helpful for leveraged buyouts, infrastructure transactions, and capital-intensive industries. It maximizes permissible deductions, better preserves free cash flow, and offers increased flexibility in structuring debt. PE companies can now manage optimal debt levels across portfolio companies without suffering compressed tax shields.

| Metric | EBIT Limitation (Pre-OBBBA) | EBITDA Limitation (Post-OBBBA) |

| Deduction base | Earnings Before Interest & Tax | Earnings Before Interest, Tax, Depreciation, Amortization |

| Impact | Lower deductions | Higher deductions |

| Effect | Tighter leverage limits | More flexibility for LBOs |

Bonus Depreciation & Section 179 Expensing

OBBBA permanently reinstates 100% bonus depreciation for eligible property that goes into service after January 19, 2025. This enables instant full expensing of capital expenditures, which is especially helpful to manufacturers, logistics companies, and energy producers. Also, the Section 179 expensing limitation has been increased to $2.5 million, promoting small and middle-market companies to invest more boldly in equipment, technology, and fixed assets, with quicker payback.

| Tax Provision | Pre-OBBBA | Post-OBBBA |

| Bonus Depreciation | 80% | 100% |

| §179 Expensing Cap | $1.05 Million | $2.5 Million |

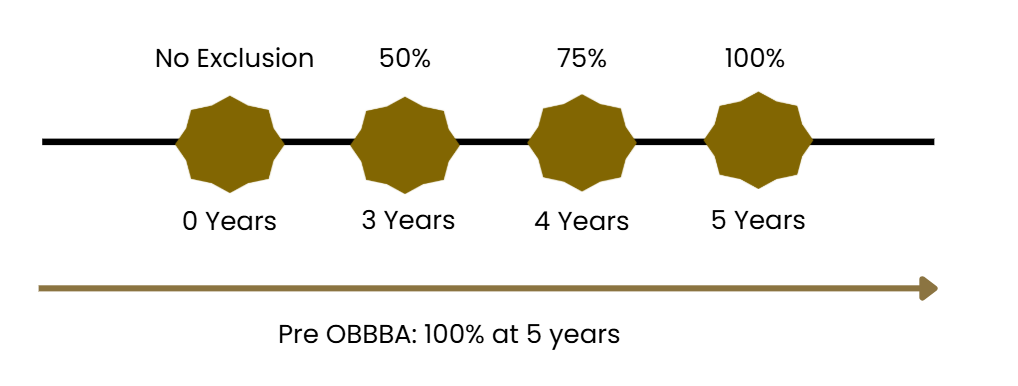

QSBS Expansion – IRC Section 1202

- Exclusion cap increased to greater of $15M or 10× basis (up from $10M).

- Gross asset limit raised from $50M to $75M.

- Excess gains taxed at ~28% collectibles rate.

- Encourages private equity investment in startups & high-growth sectors.

- Supports earlier exits and C-corporation structuring flexibility.

- Tiered exclusions by holding period:

Foreign Investor Relief – Section 899 Removed

- Proposed Section 899, which would have imposed withholding taxes on foreign investors, was excluded from the final OBBBA legislation.

- This preserves the structural integrity of cross-border fund vehicles.

- Ensures the continued attractiveness of U.S. private equity to global limited partners (LPs).

- International fundraising efforts remain unaffected.

- Protects foreign investor participation without new compliance burdens.

- Reinforces the U.S. as a stable jurisdiction for inbound private capital.

Portfolio Company – Level Impact

The tax reforms enhance financial performance and operating efficiency for portfolio companies. Expensing of R&D and capital expenditures on an immediate basis, enhanced deductibility of interest, and depreciation recovery contribute to increased after-tax cash flows. This facilitates quicker reinvestment in growth, enhanced EBITDA margins, and better enterprise valuation. Tax savings also offer debt repayment or financing of new projects flexibility.

- Increased Cash Flow

- Accelerated Write-offs

- Immediate Deduction

- Enhanced Capital Allocation

- Increased Valuations

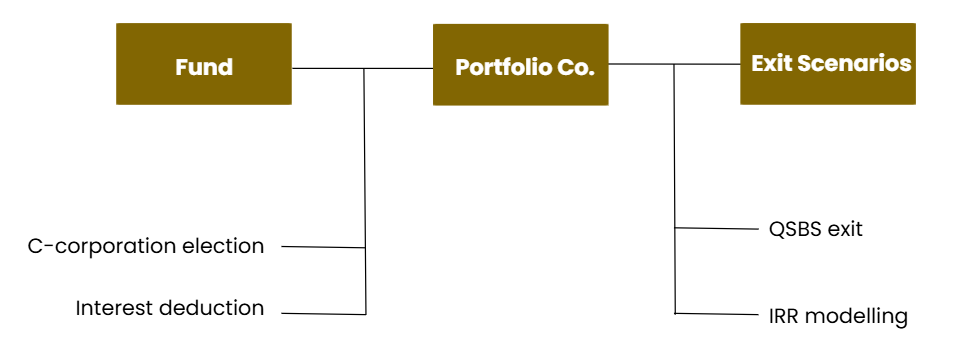

Fund – Level Planning Opportunities

OBBBA produces greater structuring flexibility and tax planning. GPs can now consider electing C-corporation status on selected entities to optimize QSBS incentives or align more with exit horizons. Greater interest deductibility allows for more leverage and refinanced capital structures. Exit projections and IRR modeling can be maximized by applying new depreciation schedules and staggered QSBS exclusions, producing greater returns to both GPs and LPs.

Unchanged Tax Provisions under OBBBA

These unchanged provisions provide a sense of regulatory certainty amid broader tax reforms. By keeping the existing rules for carried interest and long-term capital gains, OBBBA supports the core financial structure of private equity funds. Allowing PTET workarounds helps funds manage state taxes efficiently; while avoiding new taxes on BDCs and private credit protects alternative investment strategies. This stability gives GPs and LPs the confidence to move ahead with structuring, fundraising, and long-term planning.

| Area | Status | Implication |

| Carried Interest | Unchanged | Retains GP economics |

| Long-Term CG Rate | Unchanged | Exit tax planning stable |

| SALT Cap Workaround | Preserved | PTET strategies valid |

| Foreign LP Tax | Removed | Global fundraising protected |

Strategic Takeaways for Private Equity Sponsors

- OBBBA enhances the strategic tax levers of private equity firms.

- Increased accelerated depreciation and broadened QSBS benefits enhance value creation potential.

- Improved interest deductibility enables more effective leverage and capital structuring.

- Long-term capital gains stability and carried interest maintain predictable fund economics.

- Simplified rules and exemptions kept in place diminish uncertainty in fundraising and LP communications.

- Private equity firms are well-positioned to match exit strategies with tax-effective timelines.

- The Act establishes a stable, pro-growth tax climate for investors and funds.

Summary and Outlook

The One Big Beautiful Bill Act provides focused tax relief to private equity without upsetting bedrock aspects of the business. It increases tax planning, structuring of funds, and valuation levers without losing the established long-term incentives that inspire investor trust. In the short term, companies can take advantage of these changes to fine-tune models, sharpen strategies, and drive outcomes throughout fund lifecycles.

- Private equity Tax Relief: Focused and targeted; preserves core tax rules.

- Future Outlook: Use this window to optimize models and lifecycle planning.

- Strategic Advantage: Enables better fund structuring and valuation.

The information contained in this post is merely for informative purposes and does not constitute tax advice. For more information, feel free to reach us at [email protected]

Copyright 2025 Small World Business Advisors LLC www.swbadvisors.com