The private equity landscape has reached a critical time period in 2025. Following numerous years of exponential growth rates, dealmakers now experience a very different reality of longer hold periods, tighter liquidity, and changing investor expectations. Many portfolio companies are now being held far beyond when they were originally expected to exit, creating additional pressure from limited partners (LPs) to expedite capital distribution back to investors. Simultaneously, capital formation cycles are lengthening as LPs become more strategic and selective with investments and dealmakers demonstrate capital discipline and efficient capital distributions.

This landscape presents a broader challenge for CFOs, deal teams, and LPs as they strive to navigate a complex scenario, reconciling the near-term focus of monetizing value versus the long-term focus of creating sustainable value. And to add to the complexity, the evolving tax reform (think One Big Beautiful Bill Act (OBBBA)), increased scrutiny on management’s compliance with regulations, and demands for better valuation transparency are all increasing the scrutiny on dealmakers.

This edition of TaxJourney® highlights deal-making trends that continue to shape U.S. private equity in 2025. From holding periods to liquidity considerations, this edition uncovers realities that can help navigate today’s reality while presenting tomorrow’s opportunities.

Deal Activity & Exit Environment

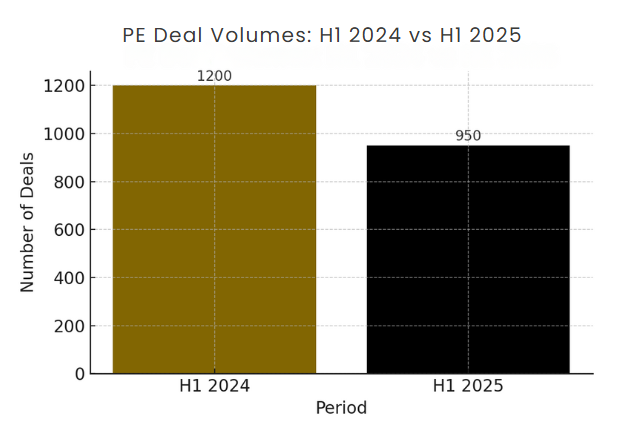

The recovery in private equity dealmaking has not progressed consistently in the first half of 2025. Transaction volume overall is subdued, and firms are still grappling with valuation gaps, high interest rates, and low availability of credit. Most managers have still withheld capital deployment pending clearer pricing and macroeconomic stability.

However, within this relatively flat landscape, exits ramped up in selected segments. In the first half of 2025, industry data shows firms announced 215 large exit transaction, a total value of $308 billion, representing the strongest mid-year proceeds in three years. Strategic buyers were the leaders in supporting these transactions, while IPO activity was muted, and results dwindled due to declining secondary buyouts (-9%) year-over-year. These selective exits show assets with reasonable preparedness and quality can still receive competitive bidder attention despite wider pressures.

One of the key trends is the lengthening of holding periods. Data shows that 35% of portfolio assets have now been held in excess of six years, which has led to substantial NAV being tied up and growing concerns by LPs regarding liquidity levels. With the mounting pressure, many firms are moving in the direction of more flexible valuations: 40% of managers indicated they would accept 5-10% discounts against their original underwriting in order to release liquidity; another 24% indicated they would accept larger haircuts between 10-20%.

In turn, market data shows firms are focusing on being exit ready much earlier in the cycle. 93% of private equity professionals indicate that being prepared to exit prior to the sale process will maximize valuations. Almost half of all professionals now begin their exit planning 12-24 months prior to sale, as being aligned around tax implications, buyer positioning, and valuation strategy much earlier in the sale process is an emerging competitive differentiator for deal teams.

Implication:

Although aggregate deal volumes continue to remain low, controlled exits are creating opportunities for value creation as well as liquidity. Managers, who are able to exit portfolios sooner rather than later and manage investor expectations while still applying discipline to exit processes, will be best positioned to return cash to LPs and maintain investor confidence during challenging times.

Liquidity & NAV Pressure

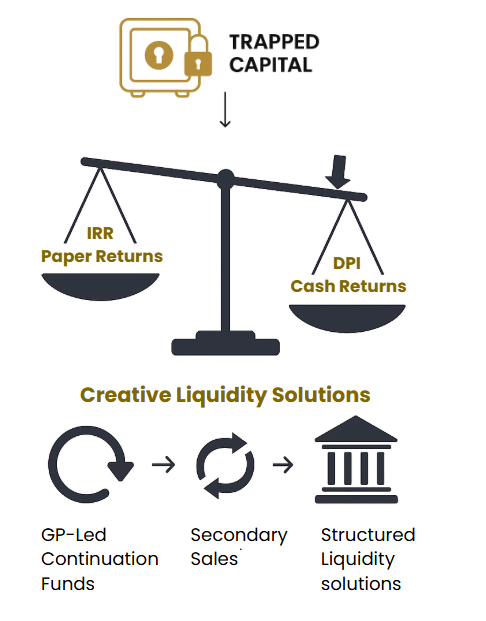

The dilemma of trapped capital versus investor liquidity is defining the landscape for private equity in 2025, as there remain a large percentage of net asset value (NAV) trapped in aged vintage funds; over 30,000 assets are waiting to be monetized. More than 35% have been held for over 6 years, which is much longer than intended by the original investment process. This creates a challenge for managers in recycling capital for new investments.

Limited partners (LPs) are moving away from traditional measures (i.e. internal rate of return (IRR)), and instead, are increasingly focused on distributions to paid-in capital (DPI). While IRR remains an important metric especially for mid to late cycle funds, the current situation is more about realized cash. In fact, 40% of GPs said they would accept a 5 to 10% discount to their original underwriting for immediate liquidity, and a further 24% said they would agree to a bigger discount of 10 to 20% to get distributions to their LPs.

Fund managers are turning to creative liquidity solutions such as GP-led continuation funds, secondary sales, and structured deals. These approaches provide partial distributions to LPs while preserving long-term ownership of high-quality assets, avoiding forced liquidations at weak valuations.

Implication:

Liquidity planning has become a strategy. Firms that can balance prolonged holding periods with innovative solutions will not only ease LP pressure, but will also become pressure tested in a capital formation constrained environment.

Fundraising Environment

Fundraising has become one of the top concerns for private equity managers in 2025. With fewer exits and delayed distributions, limited partners are pressing harder for realized returns before committing fresh capital. The result is a fundraising cycle that is more selective and far more competitive.

Recently published figures from the market demonstrate that closed fund values are nearly $223 billion for the first half of 2025 and are projected to be down 20% this year. Large funds continue to dominate inflows while mid-market and emerging managers face more challenges.

LPs also are conducting more oversight and favoring those firms with real experience, operational resiliency, and cash distributions (DPI) as opposed to just paper returns (IRR). This reinforces the importance of managing liquidity as a differentiator in fundraising.

Looking forward, fundraising conditions are likely to be tight until late 2025, and the pace of exits and realizations will be an important leading indicator for capital formation in 2026.

Dynamics of the Secondary Market

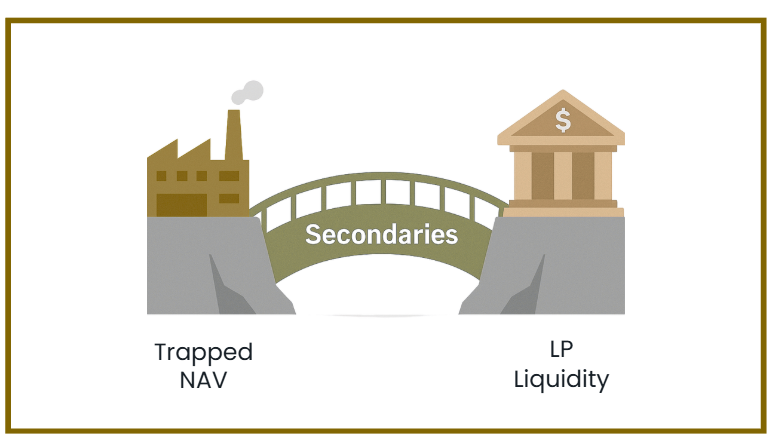

The secondary market has emerged as an important outlet for liquidity concerns within the private equity universe. GP-led funds continue to grow in popularity allowing for a mechanism for managers to continue owning quality portfolio companies while providing partial cash returns to their LPs as well. It is representative of a realignment of the exit strategy, firms are less often forced to sell as exits are more muted in the M&A space, and are leveraging continuation vehicles to maintain their value and optionality.

Similarly, secondaries are becoming a more traditional alternative to IPOs and traditional trades. A secondary allows one PE fund to sell its stake in a company to another PE fund, providing liquidity for the selling fund while maintaining an asset that continues to be part of the an ecosystem of private equity.

The market is not only increasing in use but also in scale. 2024 was an all-time high for secondaries fundraising at over $90 billion raised and just for H1 of 2025, there has been another $60 billion since then, without factoring full 2025 data, and we are already on track to surpass previous highs in 2025. However, despite all the record fundraising, the market is still described as undercapitalized expeditious deal flow continues to outpace capital. Roughly half of H1 2025 fund inflows were in one large fund is indicative of considerable supply and demand imbalance present in Fundraising Markets.

All of these developments combined are changing the expectation of capital in the industry. For investors, secondaries mean more creative exit pathways; for fund managers, they provide the tools to balance portfolio management while meeting LP expectations for distributions.

Sector & Geographic Trends

Private equity deal activity is experiencing significant sector divergence in 2025 instead of being evenly distributed. Technology and healthcare, for example, continue to garner strong investor interest, as a result of structural growth drivers like digital adoption, AI-enabled efficiencies, and demand resiliency in healthcare. In contrast, the industrials and consumer-facing sectors are lagging due to slower demand growth, higher input costs and more conservative consumer spending.

Geographic allocation trends are also illustrating this divergence. For instance, according to market data UK institutions are currently allocating an average of 7% to private equity assets while Nordic investors are allocating closer to 12%. Among the Nordics, Finland’s insurers are still allocating to tech, while Denmark’s banks and pensions are allocating to healthcare, co-investments, and secondaries. Sweden’s sovereign investors are holding firm, but leaning toward ESG and GP-led secondaries, while Norway’s sovereign wealth fund has largely stepped away from private equity. Macroeconomic risks are compounding these divergences. Existing tariff disputes, trade friction, and inflationary pressures are burdening supply chains and increasing volatility in valuations.

Takeaways for PE CFOs & Deal Teams

The private equity environment in 2025 is forcing CFOs, deal teams, and fund managers to revisit the leading fundamentals of portfolio and transaction management. Preparation, liquidity planning, and tightening-up the fundraising narrative as the new metrics for success.

- Plan Exits Early – Exit preparation can no longer just be a last minute exercise. Firms should commence war-gaming in a 12 to 24 month cycle to line up earlier on valuations, buyer positioning and any potential tax triggers. Early planning mitigates the risk of execution and enhances the ability to characterize flexibility when the markets clear.

- Focus on Liquidity Tools – With a large amount of NAV remaining trapped in older vintages, CFOs should take advantage of continuation funds and secondary sales and other imaginative liquidity paths to create distributions without distress exits. Modeling distributions strategically will position CFOs to meet portfolio time horizons of liquidity and expectations of LPs.

- Balance IRR vs DPI – LPs are placing a heightened emphasis on the tangible cash returns (DPI) versus the paper returns (IRR). This can cause CFOs to remain focused on strategy in the near term versus in the longer time. It is also advisable to communicate distribution options with LPs.

- Adapt Fundraising Conversations – As mentioned before, fundraising in a capital-rich market, focus on the differentiation. While its practically impossible for mid-tier and smaller firms to compete with larger firms dominating the fundraising process, distinguishing any operational finesse, specialization or intellectual capital; historical investment drawdowns; and advanced approaches to tax efficient planning should create the impression of separation.

- Observe Macro Risks – Unresolved geopolitical risk, tariff regimes, and tax reform measures in the U.S. like OBBBA complicate deal structuring. CFOs should incorporate scenario modelling and stress testing into their planning for greater robustness.

The information contained in this post is merely for informative purposes and does not constitute tax advice. For more information, feel free to reach us at [email protected]

Copyright 2025 Small World Business Advisors LLC www.swbadvisors.com